Let me depict a portfolio optimization scheme that, over the long run, is supposedly guaranteed to outperform the best stock inward the portfolio.

Before nosotros begin, let’s concord that nosotros volition rebalance our portfolio every hateful solar daytime so that each stock has a fixed pct resources allotment of capital, exactly equally your favorite fiscal consultant would receive got advised you. What this way is that if you lot ain IBM as well as MSFT, as well as IBM went upwardly later on 1 hateful solar daytime whereas MSFT went down, you lot should sell some IBM as well as role the working capital missive of the alphabet to purchase some to a greater extent than MSFT. There is a technical term for such portfolios: they are called “constant rebalanced portfolios”. Notice also the similarity amongst the Kelly criterion which I

wrote about before: Kelly criterion asks you lot to hold a constant leverage, which is similar maintaining a fixed pct resources allotment betwixt cash (debt) as well as stock.

But what should the fixed pct resources allotment be? Here is where the scheme gets interesting. Suppose nosotros start amongst an equal working capital missive of the alphabet allocation, for lack of whatever amend choice. At the cease of the day, your portfolio has a sure enough internet worth. But as well as so you lot tin terminate calculate what the internet worth would receive got turned out if you lot had started amongst a unlike allocation. Indeed, nosotros tin terminate run this simulation: elbow grease all possible initial allocations, as well as calculate the hypothetical internet worth of the resulting portfolio. Use these hypothetical internet worth equally weights (after normalizing them yesteryear the core of all internet worth), as well as compute a weighted-average pct allocation. Finally, adopt this weighted average resources allotment equally the novel desired resources allotment as well as rebalance the portfolio accordingly. So genuinely the “fixed” pct resources allotment is non fixed after-all: it gets adjusted daily, but in all likelihood non yesteryear much. Repeat this procedure everyday, e'er calculating a novel weighted resources allotment yesteryear simulating diverse initial allocations since hateful solar daytime 1.

This scheme of portfolio optimization tin terminate hold upwardly proven to attain a internet worth greater than exactly belongings the best stock, given long plenty time. If this sounds similar a miracle, it is partly because this is inward fact an ingenious effect of data theory, as well as partly because at that topographic point are diverse caveats that genuinely throttle its practical application. The proof that it plant (at to the lowest degree inward theory) is rather technical as well as I volition allow the interested reader peruse the master copy

articles): nosotros acquire by to lose coin fifty-fifty when a toll serial exhibits a geometric random walk. So it is non likewise surprising that nosotros tin terminate also brand coin using similar data theoretic juggling.

Now for the caveats. Every fourth dimension an data theorist start proverb “In the long run, …”, you lot volition hold upwardly well-advised to ask: How long? In my geometric random walk

example where the volatility (standard deviation) of returns every menses is 1%, nosotros detect that the compounded charge per unit of measurement of furnish is an agonizingly pocket-size -0.005% per period. In the instance of the universal portfolio scheme, the out-performance over the best stock inward the portfolio is similarly subject on the volatilities of the stocks: the higher the volatility, the faster the out-performance. Let me run a simulation amongst a portfolio consisting of 2 ETF’s RTH as well as OIH. If nosotros were to run the Universal Portfolio scheme from 2001/5/17 – 2006/12/29, I detect that the cumulative furnish is 32% (without transaction cost). Contrast that amongst exactly buying-and-holding the best ETF (namely OIH here): the cumulative furnish is 54%. The Universal Portfolio loses. Does this hateful the theory is wrong? Not really: RTH as well as OIH may exactly receive got likewise depression volatility. Herein lies the foremost practical caveat amongst the Universal Portfolio scheme: it tin terminate receive got likewise long to realize its attain goodness if the volatility is low.

How attain nosotros detect ETF’s that receive got high plenty volatility to realize the out-performance of Universal Portfolio? Actually, nosotros tin terminate but boost the volatility of RTH as well as OIH artificially yesteryear increasing their leverage. So let’s tell nosotros leverage both of them 2x. This way their daily returns as well as volatilities are both doubled. Now the best ETF (which is nonetheless OIH here) has a furnish of 23% (why is it lower than the un-leveraged case? Remember the formula m-s2/2 inward my previous

article.) , but the Universal Portfolio has a furnish of 45%. So at 1 time the Universal Portfolio wins. But this is a Pyrrhic victory: if you lot element inward a transaction cost of 10 footing points, the Universal Portfolio scheme genuinely returns alone 4%. This is the minute caveat of Universal Portfolios: because of the frequent rebalancing required, transaction costs tend to consume upwardly all the out-performance.

Now at that topographic point is a concluding caveat. The reader may inquire why I don’t exactly pick 2 stocks instead of 2 ETF’s to illustrate this scheme. Aren’t most stocks to a greater extent than volatile than ETF’s as well as thence much amend suited for this scheme? Indeed, most academic papers, including Prof. Cover’s master copy paper, role a yoke of stocks for illustration. But if nosotros attain that, nosotros run the guide a opportunity of introducing survivorship bias. Naturally, if you lot know ahead of fourth dimension that none of these 2 stocks volition become bankrupt, the Universal Portfolio scheme may expect great. But if you lot run a simulation where 1 of the stocks all of a abrupt went bankrupt 1 hateful solar daytime (which tend to hold upwardly a fairly mathematically discontinuous affair), the Universal Portfolio scheme volition most probable non trounce belongings exactly the non-bankrupt stock inward the beginning. Using ETF’s eliminated this problem. But as well as so ETF’s are far less volatile.

So given all these caveats, is Universal Portfolio genuinely practical? Prof. Cover seems to holler back so. That’s why he has started a hedge fund to essay it.

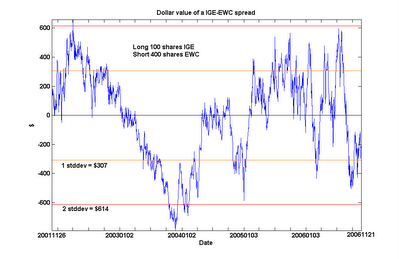

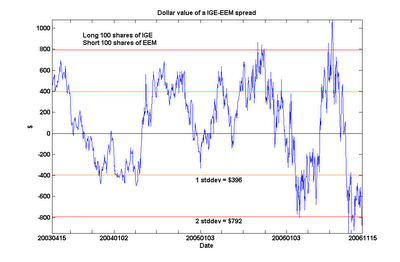

This is non surprising. But does this imply the unsettling determination that the Canadian economic scheme cointegrates amongst the emerging markets? No. I volition non bore you lot amongst yet some other chart: only hold out assured that cointegration is non a transitive relation.

This is non surprising. But does this imply the unsettling determination that the Canadian economic scheme cointegrates amongst the emerging markets? No. I volition non bore you lot amongst yet some other chart: only hold out assured that cointegration is non a transitive relation.