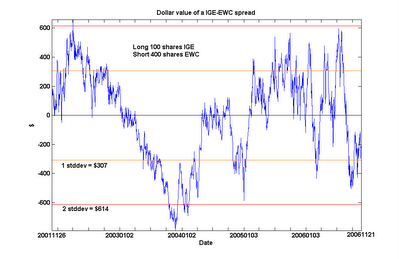

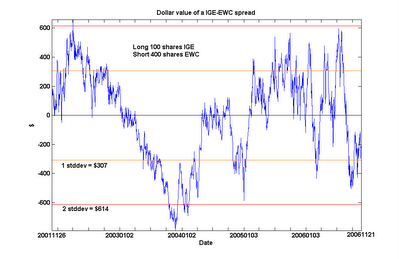

Many of us Canadians similar to mean value of our economic scheme every bit a fellow member of the advanced, post-industrial world, amongst the landscape dotted amongst brand-name companies such every bit Nortel Networks, Research In Motion, in addition to Four Seasons Hotels. In the dorsum of our minds, of course, nosotros know nosotros are too a resource-rich country. But still, it may come upward every bit a flake of an embarrassment to detect out that, of all the sector index funds nosotros tin give notice compare the MSCI Canada Index fund EWC to, it cointegrates entirely amongst the natural resources index fund IGE. Even the fiscal sector indices create non come upward close, despite the presence of numerous fiscal services companies inwards the Canada Index. As usual, inwards the nautical chart below, I plotted the spread betwixt 100 shares of IGE in addition to 400 shares of EWC, in addition to nosotros tin give notice come across for ourselves how this spread stubbornly sticks only about zero.

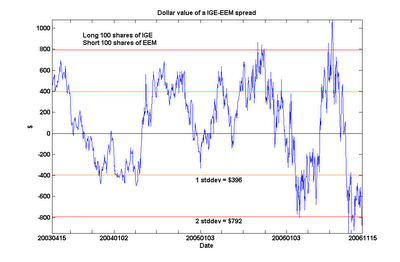

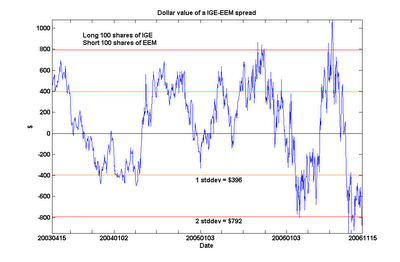

One may banking concern complaint that IGE too cointegrates amongst the Emerging Markets index fund EEM. (The nautical chart below is the spread betwixt 100 shares of IGE in addition to 100 shares of EEM.)

This is non surprising. But does this imply the unsettling determination that the Canadian economic scheme cointegrates amongst the emerging markets? No. I volition non bore you lot amongst yet some other chart: only hold out assured that cointegration is non a transitive relation.

This is non surprising. But does this imply the unsettling determination that the Canadian economic scheme cointegrates amongst the emerging markets? No. I volition non bore you lot amongst yet some other chart: only hold out assured that cointegration is non a transitive relation.

This is non surprising. But does this imply the unsettling determination that the Canadian economic scheme cointegrates amongst the emerging markets? No. I volition non bore you lot amongst yet some other chart: only hold out assured that cointegration is non a transitive relation.

Tidak ada komentar:

Posting Komentar