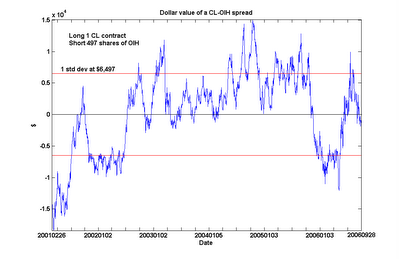

The plot is of the dollar value of long 1 contract of Cl together with brusque 497 shares of OIH. They create cointegrate alongside over 90% probability. (I besides plotted the 1 criterion departure lines of the spread to facilitate those who desire to expect for gauge entry points.) The cointegration probability is non measurably amend than that betwixt CL together with XLE. However, the electrical flow spread (as of the unopen of November 20) is undervalued past times exclusively $9,617 (or 1.48 criterion deviation), every bit opposed to $10,508 (or 1.74 criterion deviation) for the CL-XLE spread. (I determined the criterion departure of the CL-XLE spread to endure close $6,040). So inwards recent months, ane tin indeed country that OIH is trading to a greater extent than inwards describe alongside location crude cost than XLE. But every bit an arbitrageur who thinks the larger the spread, the bigger the profits opportunity, this is non an endorsement for buying the CL-OIH spread instead. Rather, I would watch adding this spread every bit a agency of diversification.

Thanks, Yaser together with Jim, for this suggestion!

Tidak ada komentar:

Posting Komentar