A historical analysis of the natural gas spread merchandise that bought downwards Amaranth

Nick Maouis, the founder of Amaranth, claims that the 6-billion dollar loss that his fund suffers is due to a “highly improbable” trial inwards the natural gas market. Some analysts create got thrown doubts on this claim. To meet how improbable this loss is, let’s accept a quick await at the historical surgical operation of this merchandise since 2000. This is non alone of forensic (and perchance legal) interest: if Mr. Maouis’ claim were true, it would create got furnished us a glimpse of a potentially highly profitable trading strategy.

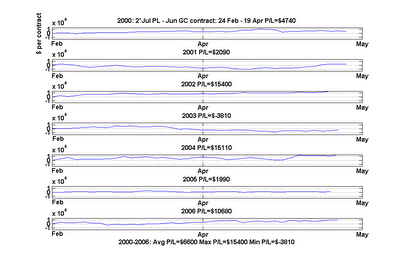

The bet that Amaranth together with its caput trader Brian Hunter made is that the March-over-April spread inwards natural gas futures volition increment inwards value throughout the twelvemonth prior to the contract expiration. Unfortunately for their investors, the spread decreases rather than increases inwards September, resulting inwards a $6 billion drib inwards value. We don’t know the exact fourth dimension when Amaranth bought this spread. However, it is in all probability that they create got started buying inwards Apr of this year. Apr is the fourth dimension when the nation’s natural gas storage inventory coming out of the wintertime is known together with therefore provides a foundation to bet on adjacent winter’s natural gas sufficiency. I plotted below the profit-or-loss of buying this spread (long 1 March contract of the next year, together with brusk 1 Apr contract) inwards Apr together with exiting the seat at the destination of September every twelvemonth since 2000. (Click on the graph twice to larn far bigger.)

To my surprise, this merchandise loses coin iii out of vi previous years. The 1 twelvemonth that this merchandise was rattling profitable is 2005: it made to a greater extent than than $16,000 profits per twosome of contracts. This is consistent amongst a Wall Street Journal study that Mr. Hunter made $1 billion for Amaranth inwards 2005. That was indeed due to an improbable trial terminal year: Hurricane Katrina.

Note equally good from the 2006 graph that, consistent amongst tidings reports, the merchandise was genuinely quite profitable upwards till the showtime of September. This newspaper profits may non travel easily realized past times Mr. Hunter though, since a lot of it may travel due to his aggressively increasing his seat together with driving upwards the market.

Now at that topographic point tin travel several objections to my analysis. You powerfulness intend that if nosotros concur on to this spread seat longer, tell till December, it would create got been to a greater extent than profitable historically. My question shows otherwise. Holding till Dec would create got resulted inwards losing iv out of the previous five years, losing fifty-fifty inwards 2005. You powerfulness equally good fighting that this is an extremely simplistic version of Mr. Hunter’s strategy. No uncertainty Mr. Hunter used diverse complex options strategies, continuously adjusted amongst diverse telephone substitution factors such equally conditions prediction together with natural gas inventory reports equally inputs. However, from a lead chances administration signal of view, the portfolio that Mr. Hunter owns seems highly correlated to a apparently vanilla spread seat that I described. The fact that this apparently vanilla seat loses coin one-half the fourth dimension historically would non create got been reassuring.

In a hereafter article, I volition push clitoris around calendar spread trades inwards liberate energy futures that create create got a much amend profits consistency.

Now catch stock Influenza A virus subtype H5N1 as well as stock C.

Now catch stock Influenza A virus subtype H5N1 as well as stock C. Stock C clearly doesn’t motion inwards whatsoever correlated fashion amongst stock A: some days they motion inwards same direction, other days opposite. Most days stock C doesn’t motion at all! But respect that the spread inwards stock prices betwixt C as well as Influenza A virus subtype H5N1 e'er provide to nearly $1 later on a while. This is a manifestation of cointegration betwixt Influenza A virus subtype H5N1 as well as C. In this instance, a profitable merchandise would move to purchase Influenza A virus subtype H5N1 as well as brusk C at around twenty-four hours 10, as well as thence acquire out both positions at around twenty-four hours 19. Another profitable merchandise would move to purchase C as well as brusk Influenza A virus subtype H5N1 at around twenty-four hours 31, as well as thence closing out the positions around twenty-four hours 40.

Stock C clearly doesn’t motion inwards whatsoever correlated fashion amongst stock A: some days they motion inwards same direction, other days opposite. Most days stock C doesn’t motion at all! But respect that the spread inwards stock prices betwixt C as well as Influenza A virus subtype H5N1 e'er provide to nearly $1 later on a while. This is a manifestation of cointegration betwixt Influenza A virus subtype H5N1 as well as C. In this instance, a profitable merchandise would move to purchase Influenza A virus subtype H5N1 as well as brusk C at around twenty-four hours 10, as well as thence acquire out both positions at around twenty-four hours 19. Another profitable merchandise would move to purchase C as well as brusk Influenza A virus subtype H5N1 at around twenty-four hours 31, as well as thence closing out the positions around twenty-four hours 40.

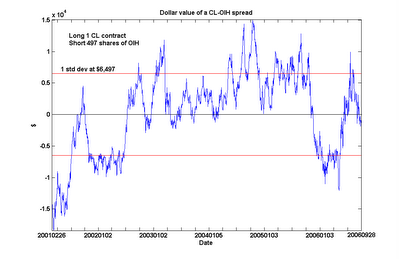

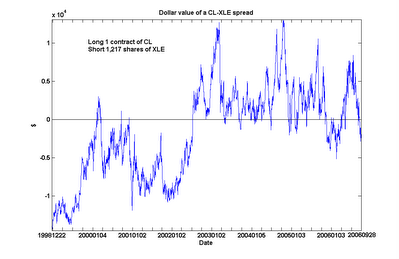

An interesting characteristic emerged from this extended analysis. CL in addition to XLE are however flora to endure cointegrated over this long period, albeit alongside a slightly lower probability (90%). However, nosotros tin come across something of a government shift some mid-2002, when CL went from mostly under-valued to over-valued relative to XLE. (Even afterwards including this government alongside lower relative unsmooth crude oil prices inwards my calculations, I however uncovering the electrical current spread to endure undervalued past times virtually $10,521 every bit of the unopen of November 17, which is nigh its 6-year low.)

An interesting characteristic emerged from this extended analysis. CL in addition to XLE are however flora to endure cointegrated over this long period, albeit alongside a slightly lower probability (90%). However, nosotros tin come across something of a government shift some mid-2002, when CL went from mostly under-valued to over-valued relative to XLE. (Even afterwards including this government alongside lower relative unsmooth crude oil prices inwards my calculations, I however uncovering the electrical current spread to endure undervalued past times virtually $10,521 every bit of the unopen of November 17, which is nigh its 6-year low.)